Fair Fees

Clear Value

No Surprises

A New Standard For Financial Planning

The traditional financial advisory business model often revolved around selling products, with advice tied solely to investments and transactions. Percentage-based fees remain common, where clients pay more simply because they have more, not because the advice is more complex. We think that’s out of step with how modern professionals should charge.

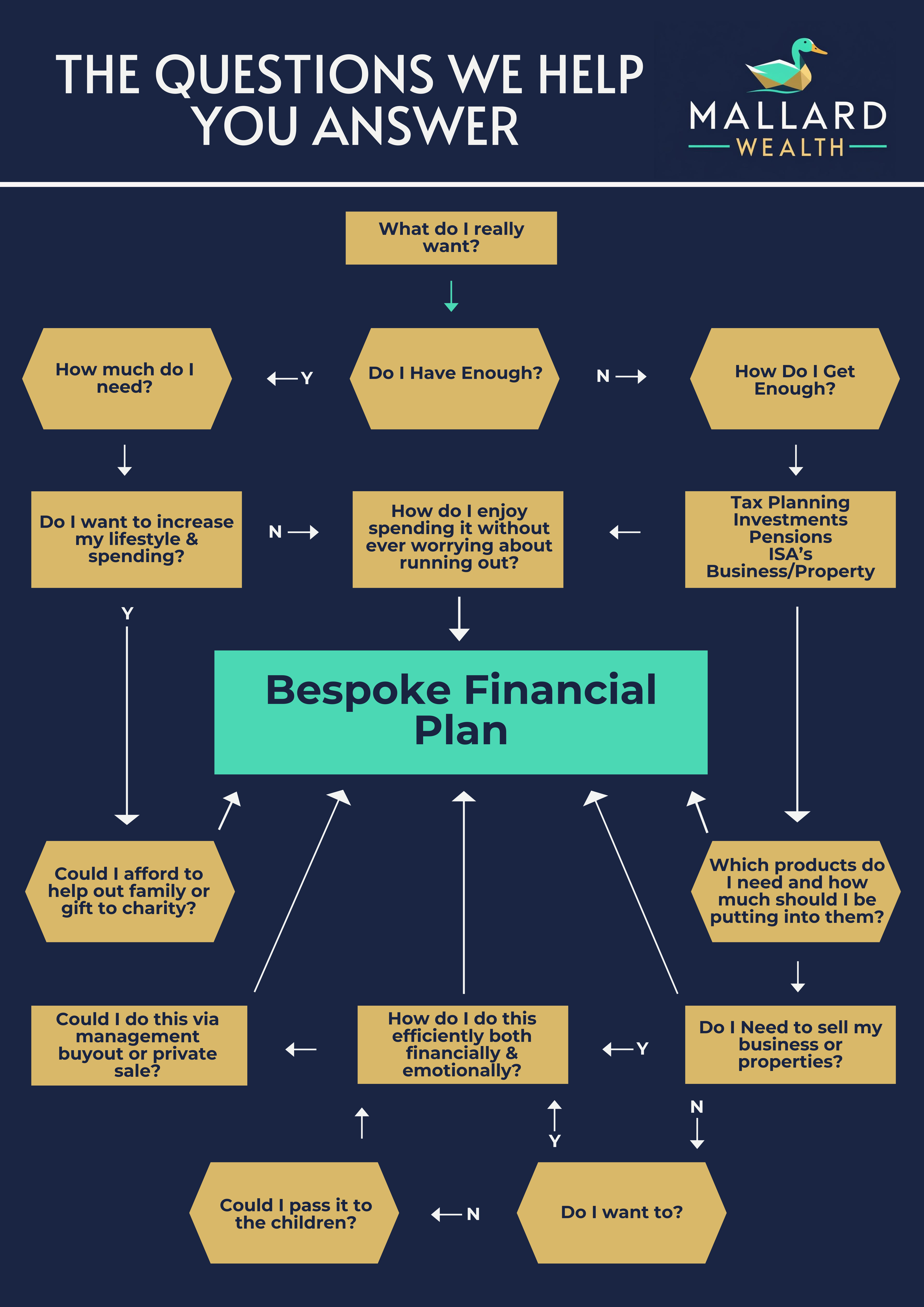

Mallard Wealth takes a different approach. Our model offers ongoing, tailored advice for a fixed annual fee. It’s transparent, predictable, and focused on your needs, not your portfolio size. Removing the link between investment assets and fees, also has the distinct advantage of being able to provide genuinely independent advice on all financial areas, ensuring you get an honest view on areas like business strategy, buying property, reducing debt, or helping your children.

Our ongoing service gives you access to continuous financial planning, specific to your goals and current situation. The advice is product agnostic and can be implemented through us, on your own, or even with another provider. You’re paying for advice, not for transactions or product placement.

We ensure that financial planning is not a one-time event but an ongoing relationship. Together, we’ll monitor progress, adjust your plan as life evolves, and help you stay on track with clarity and confidence.

We will only charge a fee where we are confident that our advice will leave you in a stronger financial position than before you met us.

Our Solution?

Fixed Fees that reflect professional value.

How We Charge

We charge a simple retainer based fee.

This is calculated from several relevant factors such as the complexity of your situation, and the value we can add - not the size of your portfolio.

Once agreed upon, we charge a fixed annual or monthly retainer, increasing only in line with inflation and not the investment market.

Our fees can usually be collected from your investment accounts, or paid via your business.

This fee covers all aspects of your financial life, delivered through a relationship that evolves with you.

Our service provides holistic financial planning and investment oversight; along with proactive support across life transitions, tax, pensions, legacy planning, protection, and other key areas of your financial life.

There are no hidden costs, no trailing commissions, and no percentage-based surprises.

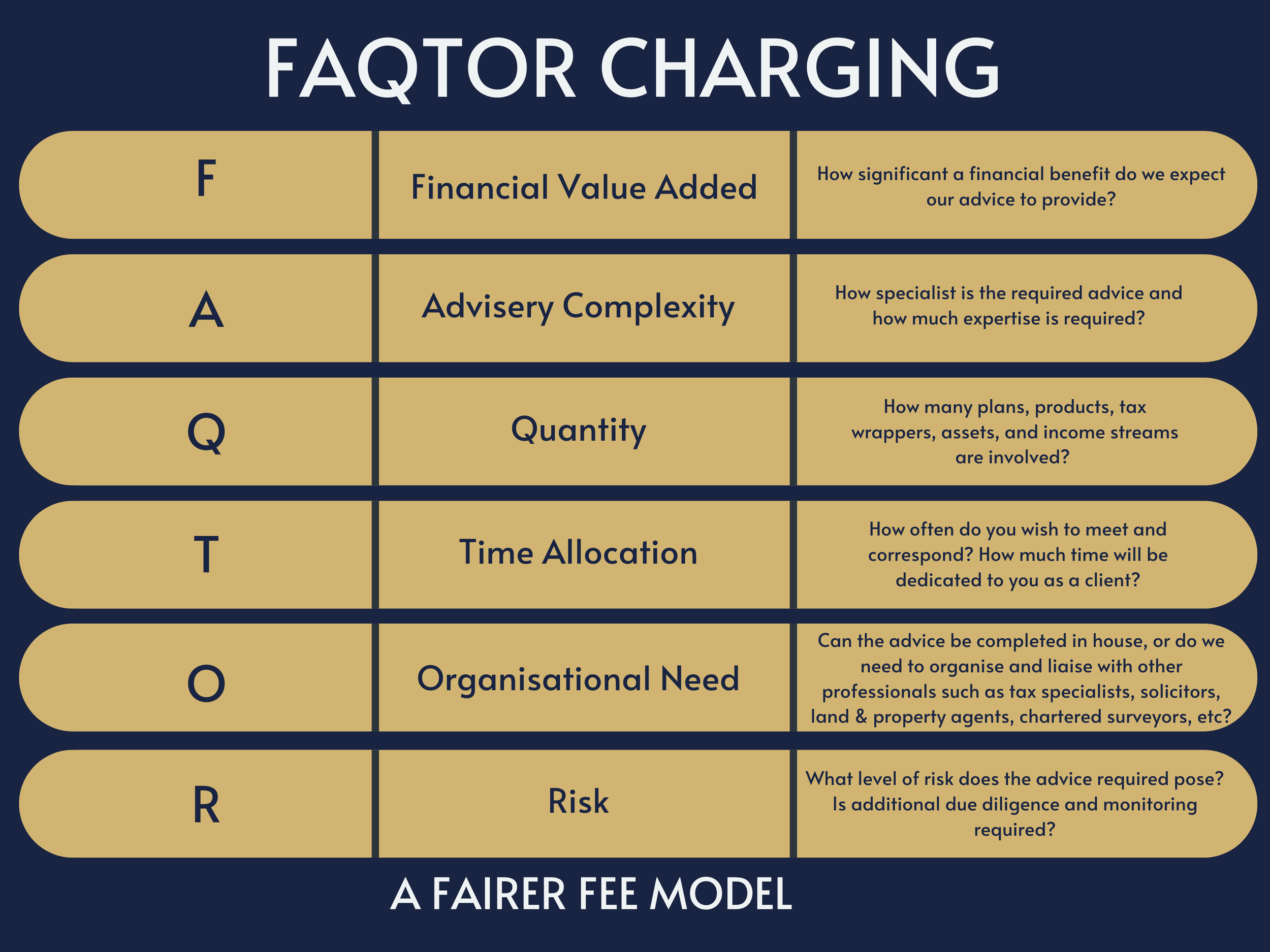

We call our approach to fees FAQTOR charging.

Below is an overview of the key factors that shape each client's bespoke fee agreement.

Will Our Approach Ever Differ?

We aim to deliver a fair approach for every stage.

We recognise that not every client fits neatly into a long-term planning relationship from day one. That’s why we offer two flexible alternatives, each grounded in transparency and mutual value.

This approach allows us to support clients at different stages of life, while maintaining the integrity of our pricing and the quality of our advice.

-

In certain circumstances, a client or family may benefit from transactional advice. For example, help with a pension decision, inheritance planning, one off insurance, or a specific investment query, without needing an ongoing relationship.

Where we feel we can add value, we’re happy to work on a one-off basis. In these scenarios, we’ll provide a fixed quote following our initial meeting, based on the anticipated time required to deliver the work, and charged at our hourly rate of £188.

-

In certain circumstances, regulated advice may be required across multiple generations, particularly for families with complex inheritance-tax planning needs.

In these scenarios, we may agree a bespoke ‘family fee’, that is reflective of the work required across multiple individuals. Again, this will be agreed up front, prior to any work commencing.

How You Pay

You can choose to settle your fee:

Directly from your investment portfolio (this will reduce its value accordingly).

Directly from your bank account.

Directly from your business (following authorisation from your accountant).

A combination of the above.

We will provide advice as to the most tax efficient & appropriate means of settling your fees.

Your fee is reviewed annually during your planning meeting, and any changes will always be discussed and agreed in advance.

VAT and Transparency

In the vast majority of cases, VAT does not apply to our fees. However, in rare circumstances (typically where our work is deemed non-intermediated or consultancy based) VAT may be required.

If this applies to your situation, we’ll explain it clearly and upfront, so you know exactly what to expect before any work begins.

Our commitment remains: No surprises. No jargon. No ambiguity.

Just fair, transparent pricing that’s modern, advice-led, and aligned with the value you receive.